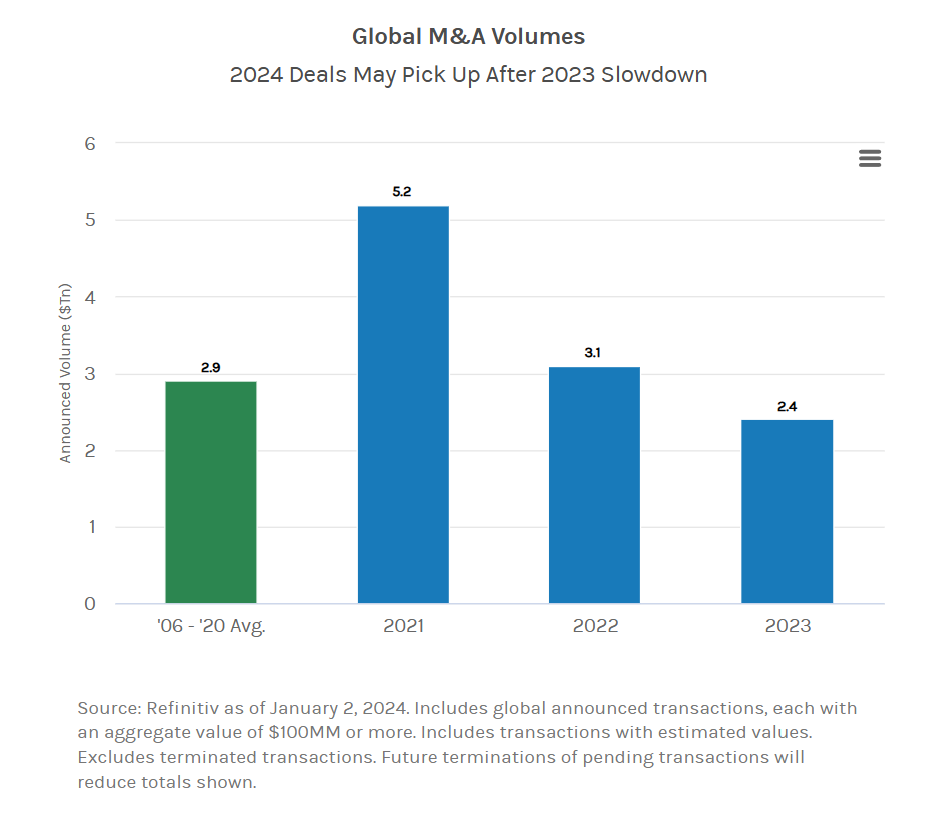

Mergers and acquisitions (M&A) are expected to rebound in 2024 after experiencing a slowdown in 2023, according to recent analyses by Morgan Stanley. Our Saudi M&A Consulting team highlights several key trends that indicate why deal-making is likely to pick up this year, offering valuable insights for those involved in the sector.

Factors Behind the 2023 M&A Slowdown

The M&A environment was muted in 2023 due to several factors. Global inflation remained high throughout most of the year, only easing towards the end, leading central banks to maintain elevated interest rates. These higher rates increased borrowing costs, making it more expensive for buyers to finance M&A deals. Additionally, equity markets faced challenges, reducing valuations and creating uncertainty. Large M&A transactions also faced increased regulatory scrutiny, impacting the number of significant deals.

Capital markets were less open and dynamic, with private equity activity lower than expected. However, market forces are set to drive an inevitable return. It’s a matter of when, not if.

Trends to Watch in 2024

- Strengthening Corporate Activity

Corporate acquisition activity is expected to increase in 2024. The S&P 500 Index ended the year near record highs, corporate balance sheets are strong, and financing markets are improving. CEO confidence, which closely correlates with M&A activity, is rising, with CEOs anticipating higher growth in revenue and profitability in 2024 compared to 2023.

Increased activity is anticipated in sectors such as energy, technology, and healthcare:

- Energy: With strong operating cash flows and balance sheets, energy companies are looking to broaden their portfolios. Recent notable transactions in 2023 include Chevron acquiring Hess and ExxonMobil taking over Pioneer Natural Resources.

- Technology: Activity is expected to pick up as buyers and sellers find common ground on valuations. Some technology companies may also seek capital to continue their growth plans, driving more M&A.

- Healthcare: Particularly in biotechnology, companies may look for M&A opportunities to enhance their research efforts.

Long-term trends like artificial intelligence, ESG factors, and regulatory impacts could influence activity across all sectors. Additionally, complex deal structures, such as stock-for-cash exchanges and minority stake sales, are likely to continue as viable options.

- Financial Sponsors: Buyers and Sellers

Financial sponsors are expected to accelerate their buying and selling activities in 2024. With a record $1.9 trillion in dry powder, there is a substantial inventory of private equity-owned assets that need to be monetized. The easing of monetary policy, as indicated by the Federal Reserve, could facilitate easier lending and more exits.

Private equity firms might also seek alternative paths to liquidity, such as minority stake sales, recapitalizations, and continuation fund situations, before the market for sponsor-backed company sales fully rebounds.

- Activist Campaigns and M&A Solutions

Activist investors are likely to push for M&A solutions, especially for undervalued companies. As financing markets become more hospitable, there is pent-up demand for sponsor take-private solutions.

- Corporate Separations for Clarity

Corporate separation activity is expected to continue, with companies spinning off parts of their organization to streamline operations or raise capital. These transactions, which enhance balance sheet strength, profitability, and earnings stability, are likely to gain ongoing investor support.

- Cross-Border M&A and Regional Economic Factors

Economic challenges in Europe, exacerbated by the Russia-Ukraine and Israel-Hamas conflicts, have driven European companies to increase their exposure to U.S. markets. Additionally, Japanese companies may seek to invest abroad to increase yields as the country emerges from deflation.

In conclusion, the M&A market is poised for a strong comeback in 2024, driven by strengthening corporate activity, the return of financial sponsors, activist campaigns, corporate separations, and cross-border deals. For those involved in these sectors, our experts at Saudi M&A Consulting offer the insights and strategies needed to navigate and capitalize on these emerging opportunities.